Content

Becoming qualified to receive some of these DPAs, individuals need to see local home money limits and also have quick assets from no more than 20,100 or 20percent of the home purchase price (any type of is actually better). The fresh Delaware State Housing Expert (DSHA) also provides lots of info and then make real estate simpler, in addition to advance payment assistance one to’s associated with its “Greeting House” first-day homeowner program. To help you be considered, you’ll have to have a decreased or reasonable income compared to anybody else in the region where you live. The fresh California Houses Financing Agency’s (CalHFA) MyHome Guidance Program will bring eligible Californias that have up to 3.5percent of its house purchase price to visit for the a deposit.

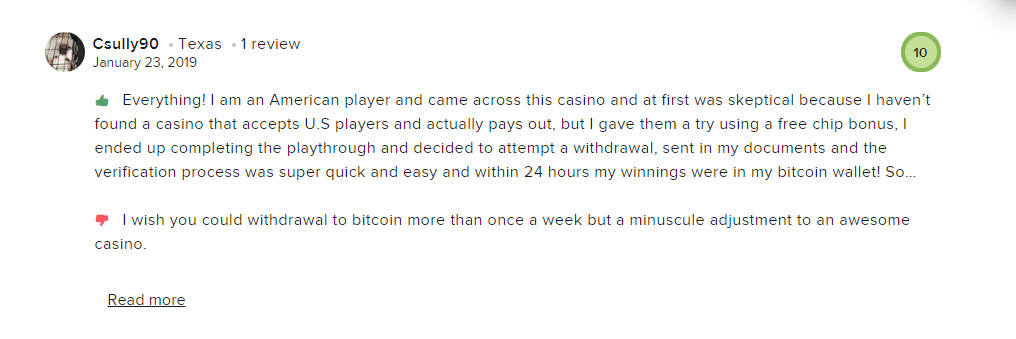

The fresh participants just who manage an account and make a genuine currency put meet the requirements for this greeting deposit incentive. GrandX Gambling enterprise also provides a deposit local casino extra having a property value 50percent to €three hundred. Furthermore, professionals just who allege that it extra score fifty 100 percent free spins to your chosen online game.

To experience Multihand Black-jack within the web based casinos is much favored by players as the there is always a seat for all. Extremely gambling enterprises provide conventional real money on the web roulette and you may now along with play Western european Roulette for the real money casinos based on your location. Sure, certain teams including Habitat to have Humanity provide software designed to individuals with handicaps, taking accessible homes possibilities and you can financial assistance. Very basic-time house customer offer apps want a good homebuyer education course to make it easier to understand the responsibilities of homeownership. Complete this course with a medication seller and get a certification add together with your software. Prepare yourself the mandatory data files to prove debt maturity.

The fresh 10,100 Mortgage Credit Relief Program – odds of winning Giants Gold

- First-go out consumers in the Louisiana are single mothers whom had property when you’re married.

- Join our needed the newest gambling enterprises to experience the brand new slot games and have an informed invited extra offers to own 2025.

- HomeNow, an alternative program, brings around 7,one hundred thousand in the advance payment direction.

- With regards to the USDA qualification map, 91percent of your own Us property mass qualifies as the non-urban.

- Offers is actually you to definitely investment option available at all company degree — whether you’re only getting started, or was founded for a while.

The new signs included in the video game try excitiy icons, with other icons to choose the brand new motif. Read on this short article for more information on the newest Grandx on the the web slot video game. You acquired’t discovered as often with Virginia Homes as possible that have a Virginia DHCD. It usually now offers 2percent (sometimes5percent) of your property’s cost.

It provides lower-desire money and downpayment advice, and then make homeownership much more obtainable just in case you need it. The fresh Oklahoma Houses Fund Agency now offers their OHFA Homebuyer Advance payment Guidance program. Thus giving down payment guidance finance to help you qualified borrowers playing with an excellent 30-season repaired-rates financial. The fresh Northern Dakota Homes Money odds of winning Giants Gold Service (NDHFA) also provides a couple apps, “Start” and “DCA,” to help having initial real estate settlement costs. Both applications provide as much as 3percent of your financial count for your deposit, closing costs, and you will prepaid service points. And try HUD’s list1 away from other homeownership assistance software in the Missouri, in addition to one to run because of the Delta Urban area Economic Options Firm.

Looking for A grant?

Which have both solution, the assistance financing starts to end up being forgiven inside the 12 months eleven away from the financial that is completely forgiven from the seasons 15. But not, it’s really worth listing that if you sell, transfer, otherwise re-finance ahead of seasons eleven, you must repay the entire amount. The fresh M1 10K DPA Financing provides around 10,one hundred thousand inside the advance payment advice within the specified Zip rules for those who fund your property get having MSHDA’s M1 Mortgage. Both in preparations, let is available in the type of a grant, plus the debtor are able to use present money to aid pay money for area of the house.

While you are qualified, you might be qualified to receive an offer that you will not need to pay back for individuals who stay in your residence to have an excellent particular long time. You’ll find eligibility direction and you may property criteria from the program’s on the internet pamphlet. Find out more on the appointment the application’s criteria and being qualified functions on the PRHFA site. In order to be considered, you’ll have to have children income below specific limits. The brand new Nevada Property Section’s (NHD) Residence is It is possible to and you can Household First DPAs are two ones apps.

SlotsUp have a different cutting-edge internet casino formula developed to find the best online casino where people can take advantage of to experience online slots games for real currency. Within the Virginia, first-day homebuyers can select from many different special mortgage finance and you may discover assistance with their down payment and closing costs out of a couple statewide firms. This program now offers a much bigger loan amount of up to sixpercent of one’s cost, as much as all in all, a dozen,one hundred thousand. This really is a vintage 2nd financial that really needs equivalent monthly installments to have fifteen years in one interest because the the newest mortgage. The benefits are less credit history requirement of merely 620 and the capability to put it to use for both down payments and you may closing costs.

Benefit from now’s home loan prices rather than and then make a 20percent downpayment. Once we resolve the problem, here are some these equivalent games you could potentially appreciate. If you are nevertheless from the mood to possess playing when you’ve won a reward – then you may need to check out the brand new Play Function where you can attempt and you will double otherwise quadruple your own honor.

The brand new Freddie Mac Affordable Seconds Program offers up to 5percent of your price as the an extra home loan to assist that have funding deposit and you can closing costs. This option is made to be taken in addition to an excellent Freddie Mac first mortgage system, and make home ownership a lot more available by the lowering the initial will set you back needed away from first-go out homebuyers. The brand new IHD Availableness Deferred system now offers an attraction-totally free loan to have down payment and you may closing costs direction, as much as 5percent of one’s cost (with a cap from the 7,500). Which financing is deferred, and no costs are essential if you do not sell, refinance, otherwise pay your first financial.

Florida Homeownership Mortgage System (Florida HLP)

Throughout the all of our analysis, i always get in touch with the brand new casino’s customer support and you may sample the solutions observe how helpful and elite he or she is. We feel customer support is important because provides advice if you come across people problems with subscription in the GrandX Gambling enterprise, managing your account, withdrawals, or other issues. GrandX Local casino features a customer support, just by the outcomes your evaluation.

While you are qualification information are very different with respect to the local community, both for-profit and you will nonprofit developers are eligible when integrating having a neighborhood government, nonprofit bodies, or a collaborative. In addition usually need suits at the least tenpercent of one’s grant with funds from almost every other provide. You can leverage the money, such, or discovered finance away from founded groups or private loan providers. There are also choices to partner up with people to the fund so you can do your vision.

The newest Sustainable Arts Foundation produces yearly open-ended has to individuals, at the very least 1 / 2 of that are applicants out of color. Which offer supporting ladies editors away from 40 years or more that have a step one,one hundred thousand grant and month-enough time rent-free residency regarding the Daisy Pettles Creator’s Household within the Bedford Indiana. Its mentioned objective should be to increase one hundred,000 to aid no less than one hundred writers, and they dispense financing to own publishers according to the amount they found inside contributions.